Should You Be Raising Right Now?

Every few months, the startup world starts whispering about “the correction.”

It’s that invisible storm everyone feels is coming — but no one quite knows when or how bad it will be. Some investors warn founders to raise now before it hits. Others say the opposite: don’t raise, focus on building.

And somewhere in the middle, most founders just feel stuck — unsure if they should chase capital now or wait until things “stabilize.”

The truth is, there’s no simple answer.

But if you understand what’s happening in the economy right now — and what a correction actually means — you can make smarter, calmer decisions about your business.

The New Enterprise Approach to Voice AI Deployment

A practical, repeatable lifecycle for designing, testing, and scaling Voice AI. Learn how BELL helps teams deploy faster, improve call outcomes, and maintain reliability across complex operations.

What a Correction Actually Is

In plain terms, a market correction is a period when prices across public or private markets fall sharply — usually by 10% to 20% — to “correct” overinflated valuations.

It’s like when the music suddenly stops after a long party. For a while, everyone pretends it’ll keep going, but deep down, everyone knows the lights are about to come on.

Corrections don’t just hit stocks. They ripple through the whole ecosystem — venture capital, startup valuations, funding appetite, and even hiring. Investors get cautious, LPs tighten commitments, and term sheets suddenly disappear.

And when it happens, founders who’ve raised too late — or raised on unrealistic valuations — are the first to feel it.

The Economic Reality Right Now

We’re living through a strange mix of optimism and fatigue.

Governments across Europe are struggling with slow growth, rising debt, and shrinking productivity. The UK budget, for example, is already signaling a mix of spending cuts and tax rises. In simple terms — it’s not going to be a pro-business environment for a while.

In the US, the picture looks bigger but not necessarily better.

The country’s debt is expected to reach 143% of GDP by the end of the decade, and it’s already spending over $1 trillion a year just on interest payments.

At the same time, interest rates remain high. Inflation is down from the peak, but still above target. Money is no longer cheap — and that changes everything.

Venture capital is feeling it too. Many big funds are finding it harder to raise from LPs. Some, like Lakestar, have even paused raising altogether. There’s less new money entering the system, which means investors are prioritizing follow-ons over new bets.

And yet… in the middle of all this, AI has reignited investor appetite.

Big tech companies are spending billions on data centers and chips. Nvidia just passed a $5 trillion market cap, and Microsoft and Google are throwing nearly all their profits back into AI infrastructure.

So we’re in a split reality:

Traditional venture is cautious.

AI and deep tech are overheated.

Governments are broke.

Founders are confused.

Welcome to the 2025 economy.

What Founders Should Take From This

There’s a temptation to react emotionally.

You hear “correction,” and your brain says, “Raise now before everything collapses.”

But panic-raising rarely ends well.

The founders who survive these cycles are the ones who stay grounded. They don’t chase hype or try to outsmart the market. They make decisions based on their own runway, traction, and readiness — not fear.

Let’s be clear: this isn’t 2021.

You can’t just raise a few million because you have an idea and a Figma mockup. Investors are more selective, slower, and much more focused on fundamentals.

So instead of asking “Should I raise now?”, ask this:

👉 “If I raise now, what am I actually buying myself — time, growth, or distraction?”

What a Correction Means for Founders

When a correction hits, the domino effect looks like this:

Public valuations drop. Big companies lose value, and that sets the tone for private markets.

VCs become conservative. They stop taking early bets and focus on protecting existing portfolios.

Rounds slow down. It takes longer to close deals, and investors start demanding better terms.

Valuations compress. That $10M post-money you wanted might now be $6M — or less.

Bridge rounds and down rounds become common. Founders start raising just to survive, not to grow.

If you raise before the correction, you might lock in better terms and build a buffer.

If you raise after, you’ll face tougher investors but possibly healthier expectations.

The key is not to time the market perfectly — that’s impossible — but to understand where you stand when the music changes.

When It Makes Sense to Raise Now

If your company is genuinely performing — if you’ve got real traction, customers, or a clear product-market fit — it might make sense to raise while investors are still deploying.

In this environment, liquidity is uneven.

AI, climate tech, and defense are hot. B2C apps, marketplaces, and “me-too” SaaS tools are not.

So if you’re in a strong position — profitable growth, clear story, and investor interest — go for it. Strengthen your runway.

The goal isn’t to panic-raise but to buy time while terms are still decent.

Even if you don’t plan to spend the money immediately, having a longer runway gives you control. It means you can wait out turbulence instead of being forced into a bad deal later.

When You Should Probably Wait

If you’re still searching for product-market fit, raising now could be a mistake.

Investors can smell uncertainty — and nothing kills momentum faster than a founder who can’t clearly explain what’s working.

Ask yourself honestly:

Do I have real traction or just early interest?

Is my burn rate justified by growth?

Would extra funding actually accelerate progress — or just delay hard decisions?

If your answer to any of those is “I’m not sure,” then it’s probably better to hold off. Focus on validating your product, tightening costs, and improving your metrics.

Because when the correction does hit — and it will, eventually — investors will double down on the few companies that show real proof, not potential.

Remember: VC Money Is Cyclical

Every cycle looks different, but the pattern is the same.

Capital floods in. Valuations inflate. LPs get nervous. Then everything slows.

Right now, we’re in the middle of that cycle. There’s still money on the table, but it’s not flowing evenly.

The strongest founders are still raising — and the weakest ones are being filtered out.

That’s not bad news.

It’s actually healthy. It’s how markets reset.

The problem isn’t the correction itself. It’s pretending it won’t happen and building your business as if 2021 never ended.

Practical Steps to Stay Smart

Whether you’re raising now or later, here’s what to focus on:

Runway over valuation.

A fair deal today beats a perfect deal tomorrow that never closes.

Keep optionality.

Always be in casual conversation with investors. Don’t disappear for a year and then resurface desperate for cash.

Get your numbers straight.

You can’t afford vague answers anymore. Know your unit economics, CAC, and burn multiple cold.

Reduce unnecessary burn.

If the market tightens, you’ll be glad you cut early instead of late.

Don’t chase trends blindly.

Every startup deck now mentions AI. Most of them shouldn’t. Investors can tell when it’s genuine and when it’s a buzzword.

Final Thought

Market corrections aren’t the enemy.

They’re just part of the cycle — a painful but necessary reset that separates hype from substance.

If you’ve built something real, a correction won’t kill you.

It might even help you, because it forces everyone else to slow down while you keep building.

So yes, be aware of what’s happening in the economy.

Understand how tightening liquidity affects you.

But don’t build your entire strategy around fear.

Because corrections come and go.

The companies that last are the ones that stay focused when everyone else panics.

✅ If this hit home, pass it on. There’s probably a founder in your circle right now debating whether to raise or not — and clarity beats panic every time.

POLL TIME

(👉 Vote now — we’ll share the results in next week’s issue. All votes are anonymous.)

If the market correction hits next quarter, what would you do?

INDUSTRY PULSE 🩺

(Last week’s poll results)

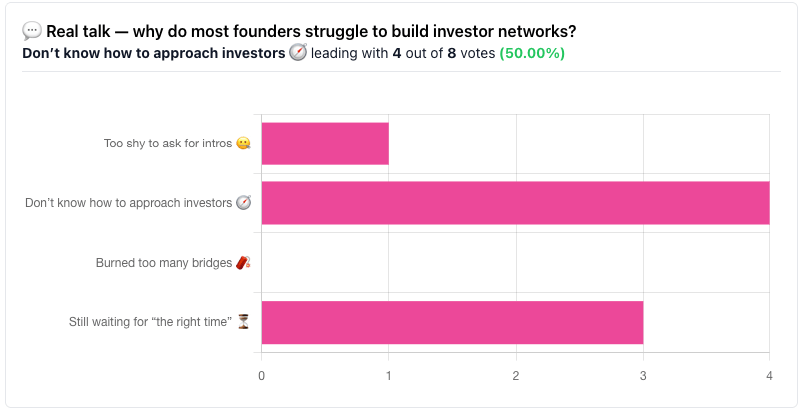

👉 Why do most founders struggle to build investor networks?

RAFE FOUNDERS EVENTS ❤️

Rare Founders

Open Mic Pitching and Networking

An energetic night where founders and innovators pitch, connect, and celebrate bold ideas in a lively, no-suit setting. Expect fast-paced pitches, spontaneous networking, and an atmosphere buzzing with creativity and community.

In-person event

The Fox, Excel Warehouse K, 2 Western Gateway, London E16 1DR, UK

Wed 12 Nov, 17:30 - 22:00 BST

Rare Founders

Co-Founder Matching Night

A fast-paced matchmaking night designed to connect founders, builders, and visionaries through AI-driven psychometric pairing and one-minute co-founder pitches. The event transforms traditional networking into a dynamic experience that sparks genuine partnerships and potential startup success stories.

In-person event

45, 45 Curtain Rd, London, EC2A 3PT, UK

Mon 17 Nov, 17:00 - 21:30 BST

Rare Founders

The Legendary Start-up Christmas Party!

Back by popular demand after a sell-out first edition, this celebration brings the startup community together for a night of music, laughter, and festive chaos. Guests can expect founder DJs alongside a headline act, festive drinks, Secret Santa, a special raffle, and the return of the beloved Christmas Duck Hunt. It’s a rare chance for founders, investors, and operators to drop the pitch decks, unwind, and end the year surrounded by the people who’ve been in the trenches with them.

In-person event

45, 45 Curtain Rd, London, EC2A 3PT, UK

Tue 9 Dec, 18:00 - 00:00 BST

Rare Founders - building the bridge between founders and investors via regular in-person and online events, meetups, conferences.