The Budget: A "Scale-Up" Dream, An Early-Stage Reality Check

If you are building your business in the UK, you need to read this.

Never have I ever thought that I would be connected to politics. For the last few years, I have been quietly working on my business, just like most of you. So far, none of my businesses have gotten beyond the pre-seed stage. Considering this is my third business and I am constantly talking to founders in our community - most of whom are fighting tooth and nail at the pre-seed to Series A stage - I believe I know exactly what it takes to start and run a business here in the UK.

In our community, we have about 20,000 entrepreneurs. I want to believe that Rare Founders represents the true voice of this community because we are dealing with the same struggles every single day.

On Wednesday, the Chancellor announced the new Budget. It has been a heavy news day. After reading the policy papers, the glossy "Entrepreneurship Prospectus," and listening to the noise online, I have some thoughts.

It is a mixed bag. But before we get into the weeds of tax rates and thresholds, we need to talk about a victory.

The Power of Our Voice

When the government pre-announced the potential "Exit Tax" on unrealized assets, it triggered me. Why, when we are taking all the risks, often not paying ourselves, and getting zero real support, should we be penalized for moving abroad at a later stage if another country offers better potential?

We didn’t just complain. We acted. We supported the open letter drafted by the Startup Coalition to challenge this tax. I believe Rare Founders is responsible for a third of the signatures collected.

And guess what? It worked. The government listened. The Exit Tax is gone.

This doesn't put cash in your bank account today, but it proves that when we push, the system moves. It creates a baseline of confidence that they aren't trying to actively kill the ambition to build.

The "Scale-Up" Budget

The government’s new mantra is "Start, Scale, Stay". They have even published a specific Entrepreneurship in the UK prospectus to prove they care.

If you look at the headlines, they are clearly trying to be "pro-business." They have appointed Alex Depledge as an advisor - an experienced founder who knows the game - and her fingerprints are on the good parts of this budget.

If you are a Scale-Up (Series B+), this budget is actually quite good for you:

Hiring Talent: The Enterprise Management Incentive (EMI) scheme has been massively expanded. You can now use it if you have up to 500 employees (double the old limit) and £120m in assets. This is a huge win for attracting top talent.

Deep Tech Funding: They are protecting the £22.6bn R&D budget and launching a £130m Growth Catalyst for deep tech.

Procurement: They are finally trying to use the government’s buying power to support innovation, with new "Champions" in every department to fast-track deals.

But here is the hard truth: Most of you reading this are not at that stage.

Detached from Reality

After reading the announcements and listening to the "policy elites" and VCs, it has become clear to me that they are absolutely detached from the reality of businesses at the early stages.

They seem to believe that fixing the issues for scale-ups will magically fix the economy. They are pouring water on the leaves of the tree while the roots are drying out.

For the pre-seed and seed founders - the people building the next generation of unicorns - the landscape just got tougher.

1. The Operational Squeeze

While the government talks about "growth," they have permanently raised the baseline cost of existence.

Hiring is harder: The National Living Wage is jumping to £12.71 per hour.

Stealth Taxes: They have frozen the Employer National Insurance threshold for three years.

Transport Costs: If your business relies on logistics or a fleet, the new 3p/mile EV tax coming in 2028 is another looming cost.

You cannot absorb these fixed cost increases forever without damaging your margins or raising prices. For a pre-revenue startup, this is deadly.

2. The Investor "Mixed Signal"

The government says they want to unlock capital, but they have tinkered with the incentives in a dangerous way. Yes, they raised the limits for VCT and EIS investment, which allows for larger rounds. That’s great if you are raising £10m. But, they slashed the upfront income tax relief for VCT investors from 30% to 20%. They are asking investors to take more risk with less immediate reward. As Emma Wall from Hargreaves Lansdown pointed out, this seems "counter to the agenda." It risks cooling the very capital we need to survive.

3. The Exit Math Has Broken

For years, the "British Dream" for many founders was selling their business to their team via an Employee Ownership Trust (EOT). It was a fair, tax-efficient way to exit. Overnight, they cut the relief from 100% to 50%. The maths has completely changed. Add to that the rise in Capital Gains Tax (BADR) to 14% and then 18%, and the "flat 10% exit" is history.

The Missing Piece: The Grassroots

The government, the advisors, and the VCs are focused on the "tipping point" of scaling. But they are ignoring the volume game.

The reason the US is so successful isn't just because they have better growth capital; it's because they have a sheer volume of companies supported at the super early stages. You need a wide funnel to get a few unicorns at the bottom.

To guarantee the UK’s prosperity long-term, we need to look at this holistically. We can't just polish the top of the pyramid. We need to:

Start with Education: Introduce kids to entrepreneurship early. Teach hard skills like tech and AI. Make it sexy.

Support the "Zero to One": We need incentives for the first £50k, not just the first £5m. We need support for VAT thresholds and trading allowances, which were completely ignored in this budget.

Recycle Success: We need to aggressively incentivize exited founders to reinvest their money back into the next generation of founders, creating a flywheel of angel capital.

Stop Complaining. Start Building.

I know it’s not easy. Politics is a messy thing, and nothing is done overnight. But I am personally tired of listening to debates and complaints about "where the UK is."

We need to change things.

The victory with the Exit Tax proves that we have influence. For me, the UK is home. I’m not planning to move to Dubai or the US anytime soon. I want my home to be better.

In our community, I have met so many smart individuals who understand finance, politics, history, and business far better than the people currently holding the pens in Whitehall. We have the collective intelligence to guide the government in the right direction.

Our Mission

The government has published a "Call for Evidence" on supporting entrepreneurs. They are asking for input.

We are not going to just send them an email.

We are creating our own Coalition of Founders. We are going to bring together the investors, the operators, and the dreamers who actually care about the UK. We are going to work together to create a Startup Blueprint for Growth - a practical, holistic plan that addresses the reality of early-stage business, not just the glossy scale-up version.

If we do nothing, nothing will change. The "policy elites" will keep tweaking the edges while the grassroots dry up.

Join us on this mission. Let’s show them what reality looks like.

✅ Help us to spread the message. We can only succeed in changing things if we are united.

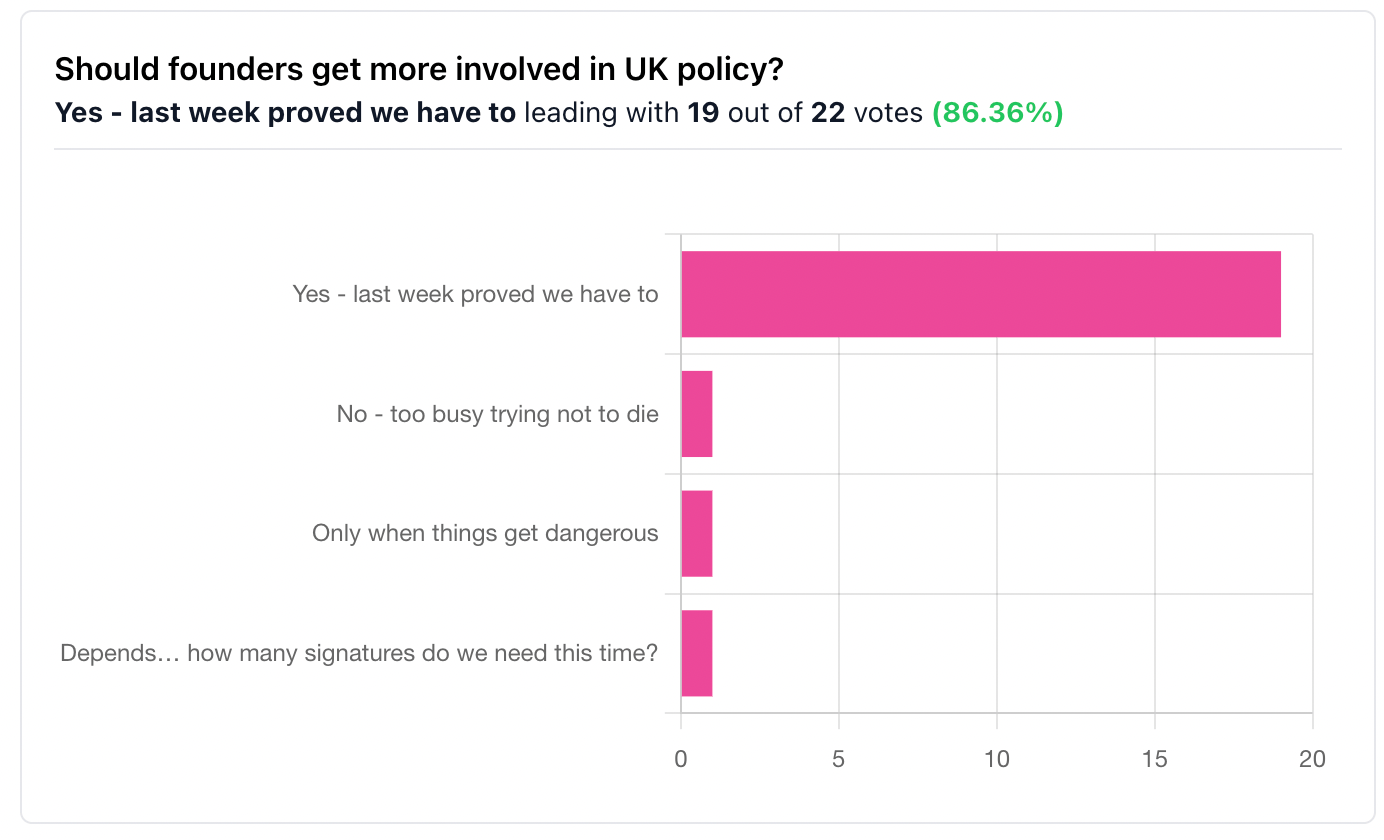

POLL TIME

(👉 Vote now — we’ll share the results in next week’s issue. All votes are anonymous.)

Overall, is this Budget a net positive or net negative for UK Startups?

RAFE FOUNDERS EVENTS ❤️

Rare Founders

Ready for Chaos? Your Xmas Party Awaits

London’s largest startup Christmas party is back, and it will be the most epic one this year. If you came last time, you know how wild it got. Santa, Secret Santa, DJs, drinks, and a raffle with stupid prizes that will make someone question their life choices. Founders, investors, operators, everyone in one room, dropping the grind for one night. The energy will be high, the mood will be loose, and the memories will be questionable. We’re close to capacity already, so grab your ticket now before it turns into one in, one out at the door.

If you want to sponsor the drinks or donate raffle prizes, reach out to Fraya at [email protected]

In-person event

The Ministry, 79-81 Borough Rd, London, SE1 1DN, UK

Wed 10 Dec, 18:00 - 00:00 BST

Rare Founders - building the bridge between founders and investors via regular in-person and online events, meetups, conferences.