How to Herd Investors Into a Close

I talk to founders every day. We all have the same problem. Fundraising is painful. You never know when to ask for money or how to get investors to commit.

My friend Chris Howard shared some wisdom with me recently. Chris is an expert on this. He is not just talking theory. He has raised more than $100M for his startups using this exact method. It works.

He learned part of this from his mentor David Cohen, the founder of Techstars, and adapted it for his own startups.

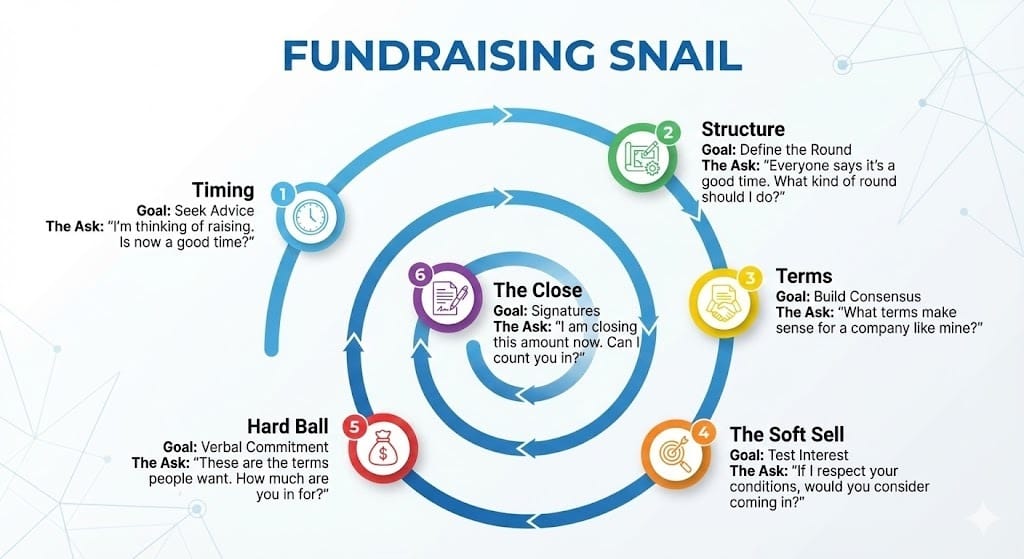

Chris compares fundraising to a snail. Or an onion.

It sounds funny. But it makes perfect sense.

Most founders try to sell too fast. They meet an investor and ask for money immediately. This is wrong. You need to work from the outside in. You start on the outside layer of the snail shell and spiral your way to the center.

Chris says there are six layers in total. You must move your investors through these layers together.

Here is how Chris Howard says you should do it.

See below to continue…

The Invisible Erosion of Performance

When performance drops, don't just blame the individual. Look at the system.

Unclear roles, weak goal alignment, and poor feedback loops quietly erode performance long before it shows up in output. What looks like a "people issue" is often a design issue. By the time an employee is labelled "underperforming," the system has usually failed them first.

With new employment protections kicking in earlier, you can no longer afford sloppy onboarding or unclear expectations. Hiring the right people into clearly designed roles matters more than ever.

Stop Managing Symptoms Underperformance is structural. Fix the system, and performance follows.

Is your probation process ready? WhatsApp me on 07340 847425 (Meena) or email [email protected] to audit your audit your team structure for clarity and impact.

Register here to join the Office Hours with Meena on Jan 16th at 12pm to ask any HR related questions.

Continue…

The Strategy: The Snail

Imagine a snail shell. You are on the outside edge.

When you are on this outside layer, you only have "outside layer" conversations. It does not matter who you are talking to. It does not matter if it is a new investor or an old contact. Everyone gets the same conversation.

You do not move to the next layer until you have enough people in the current layer. You build consensus. You create a group. Then you move everyone to the next stage together.

This helps you create peer pressure without investors ever talking to each other.

Here are the six layers.

Layer 1: The Timing Question

You are at the start. You are on the very outside of the onion.

You do not ask for money here. You ask for advice.

You go to your network and potential investors. You say this:

"I am thinking about fundraising. But I do not know if now is a good time. What do you think?"

That is it. You are simply trying to figure out if you should raise money for a startup like yours right now.

You wait until you get enough people telling you, "Yes, now is a good time". Once you are comfortable with the number of people saying this, you move to Layer 2.

Layer 2: The Structure Question

Now you go back to everyone. You tell them what you learned.

You say:

"Everyone seems to think now is a good time to raise. But I do not know what kind of fundraiser I should be doing specifically. Do you have any opinions on that?"

You are still asking for advice. You are not selling yet.

If you meet a new investor right now, you do not start at Layer 1. You put them straight into this Layer 2 conversation. You keep everyone on the same page.

Layer 3: The Terms Question

You gather their feedback. Maybe they tell you to do a pre-seed round.

Now you go to the third layer. You say:

"Hey, everyone I speak to thinks I should be doing a pre-seed round. I need to understand what terms make sense for this. Do you have an opinion on what terms suit a company like mine?"

You are building a consensus. You are finding out what terms people are happy with.

These first three layers are safe. You are only seeking advice. You are not asking for a check. This lowers the pressure.

Layer 4: The Soft Sell

Now the game changes. You flip from asking for advice to the first part of sales.

You go back to all those people who helped you in the first three layers.

You say:

"I am actually taken aback. So many people think this is a good idea to raise now. I have a good set of terms that people seem to be rallying around"

Then you ask the soft question:

"You have been so helpful. You helped me get here. I don't suppose you would consider coming into this round? If I can present good terms and respect your conditions, would you consider it?"

Notice the language. You ask if they would consider it. You ask if they would join if you respect their conditions.

You are not asking them to sign anything yet. You are not telling them who else is in. You are asking that individual fund: If I do this right, are you interested?.

Layer 5: Hard Ball

Now you spiral to the fifth layer. You start to play hard ball.

You act surprised by the demand.

You say:

"Holy sht. If everyone I spoke to comes in, I have way too much money"

This is a good problem. But you stay humble. You tell them you know not everyone will close. That would be stupid to assume.

But now you propose the specific deal.

You say:

"I am proposing a round of this size. This is the valuation. These are the terms. Does that meet your conditions?"

Usually, you will be close enough to what they want. They might say, "Cool, if other good people come in, then yes".

You ask them specifically:

"These are the terms people are rallying around. You said to come to you if I respect your conditions. How much are you in for?"

You get a verbal number.

Layer 6: The Close

This is the final layer. You are at the center of the snail.

You have your lead investor. You have permission.

You go back to the group. You say:

"Okay. These are the people coming in. I am going to get signatures now. I am going to close this amount for now"

You remind them of their promise.

"You said you would be in for this amount if I respected your conditions. I believe I have. Can I count you in?"

This is the last step before you send the legal documents and take the money.

Respecting the Conditions

David Cohen calls this "respecting the conditions".

This phrase is important. It allows you to filter people out.

If someone has conditions you cannot meet, they leave the process naturally. If you meet their conditions, they have no excuse not to invest.

It also helps you herd everyone together. You use the "consensus" of the group to convince the individual.

Managing the Process

Chris does this religiously. He has a tracking sheet. He has done this 15 times.

He tracks exactly what stage every person is in. He pushes them all through the layers of the onion together.

Sometimes, you get an investor who wants to move fast. They want to accelerate through the conversation.

This is dangerous. It breaks your process.

Chris suggests you slow them down. You say:

"This is a little later in the fundraiser than I am expecting to be right now. Let's chat, but I cannot commit to anything until I get a wider consensus from those interested"

You keep the control.

Why This Works

I love this approach because it is organized. It removes the desperation. You are not begging for money. You are building a case.

You start with advice. You move to structure. You move to terms. Then, and only then, do you ask for the commitment.

Next time you fundraise, think of the snail. Start on the outside. Work your way in.

✅ If this was useful, pass it on. You know a founder who is trying to force a close and getting nowhere. Send this to them. It gives them a strategy instead of just hope.

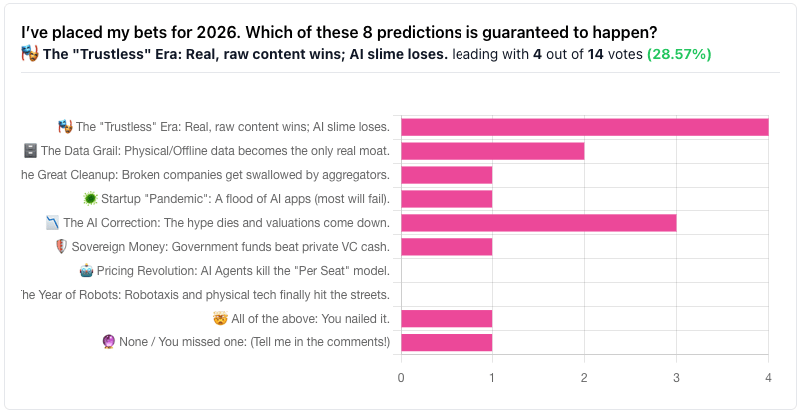

POLL TIME

(👉 Vote now — we’ll share the results in next week’s issue. All votes are anonymous.)

Be honest. When you start fundraising, what are you actually looking for in the first month?

INDUSTRY PULSE 🩺

(Last week’s poll results)

👉 I’ve placed my bets for 2026. Which of these 8 predictions is guaranteed to happen?

RAFE FOUNDERS EVENTS ❤️

Rare Founders

Dry Powder Open Mic: VCs & Family Offices Only

This event is for professional capital only (Only VCs, CVCs, Family Offices, and Syndicate Leads will be approved).

The venture landscape is moving fast. You need to know where the capital is flowing. This is your chance to talk honestly with your peers.

In-person event

The Spirited Cocktail and Tapas bar, 199-206 High Holborn, London, WC1V 7BD, UK

Wed 21 Jan, 18:00 - 22:00 GMT

Rare Founders

Open Mic Pitching and Networking - Fundraising in 2026

Raising capital in 2026 is a different game. The tactics that worked last year won't cut it now. We will be joined by Ken Thomas, Principal at Back Future VC, to discuss what it takes to get funded in this market.

The night is split between a deep-dive fireside chat and our legendary open mic sessions.

In-person event

Club 45m 45 Curtain Rd, London, EC2A 3PT, UK

Wed 28 Jan, 18:00 - 22:00 GMT

Rare Founders - building the bridge between founders and investors via regular in-person and online events, meetups, conferences.