My 2026 Predictions: The Reality Check

Everyone is busy publishing their 2026 predictions right now. Most of them are fluff. They are filled with words like "revolutionise" and "skyrocket."

I spent the holidays looking at the numbers, looking at the market, and ignoring the noise. The conclusion is simple: 2026 is going to be messy. But if you stop following the shiny objects and focus on reality, this is actually the best time to be a founder in Europe.

Here is what I think happens next year.

1. The "Trustless" Opportunity

Agentic AI has made the impossible possible: no one believes anything anymore.

We question the news, the posts, the videos. We question reality itself. Social media platforms are fighting it, but they are losing because the technology improves every day.

So, what is left? Reality.

This creates a massive opportunity for genuine experiences. In 2026, anything online that is "raw" and unedited will win. People are craving mistakes, flaws, and imperfections because they signal trust.

This translates to business: if you can prove you are real, you win. The value is moving away from polished digital content to physical, undeniable experiences.

Holidays Special Offer from Rare Founders

You are on our list because you want to build a successful business. But reading emails is not enough.

Running a company is lonely. You get stuck. You have questions about fundraising, legal, marketing, sales, etc. You need a place to go.

We created these paid tiers to give you that support network.

The Holiday Offer:

50% OFF annual plans for everyone.

60% OFF for female founders. We want more women to win, so we give you a better price.

Why you should upgrade:

Stop guessing: Get access to our WhatsApp community for genuine peer-to-peer support. When you are stuck, you ask the group.

Ask the experts: We have monthly Q&A sessions with experts in legal, GTM, marketing, and finance. It is not just about fundraising; it is about running your business.

Save cash: You get partner offers and discounts that basically pay for the subscription.

The Database: If you are raising, you get the full investor database (5,000+ records and more added on the monthly basis).

For the VIPs:

Get in the room: You get priority FREE access to all our events. This is the best networking in London.

The Intros: We make personal investor introductions for you. But we only do this if there is a relevant match.

Offer is valid until Jan 4th, 2026.

2. The Holy Grail: Data That Does Not Exist Online

Because the online world is drowning in AI slime, the "smart" money is moving offline.

Right now, every AI model is trained on the same public internet data. Whether you use OpenAI or a Chinese model, they all "know" the same things. You have no moat.

The "holy grail" for 2026 is collecting information from the physical world. Data locked in filing cabinets, sensors in a factory, or biological experiments.

For investors, this is the only way to find outliers. For founders, this is the only way to survive. If you are building a wrapper around public data, you are dead. You must own the proprietary data that Google cannot crawl.

3. The Great Cleanup (M&A is Back)

We are going to see a lot of companies get swallowed up next year.

Too many companies grew fast during the "free money" era but cannot adapt to the AI world. A perfect example is Eventbrite, which has just agreed to be acquired by Bending Spoons.

The "Bending Spoons model"—buying distressed assets and fixing them with technology—is about to become very popular. In the past, this was for old-school family businesses. Now, it applies to tech.

These companies won't disappear. They will be acquired by new teams who understand efficiency. It is a necessary cleanup.

4. A "Pandemic" of Startups

While the old guard gets acquired, a flood of new companies is coming.

With AI coding tools, a small team can build what used to take 50 people. We already have great examples coming out of Europe, like Lovable. The barrier to entry is zero.

We will see a "pandemic" of startups. New "variants" will appear every season. Most will die quickly because they don't solve real problems. But statistically, this is good news. More attempts mean more quality survivors. Europe minted 28 new unicorns in 2025. Our resilience is finally paying off.

5. The AI Correction

We need to be honest: the AI sector is finally correcting.

For two years, putting "AI" in a pitch deck opened doors. That is over. AI is a commodity.

Even the giants are feeling the pressure. It is hard for OpenAI to keep raising billions without showing massive profit. That is why they are looking at ads. That is why Anthropic is rumored to be eyeing an IPO. They need the cash.

Corporate adoption is slow. Companies are worried about privacy and hallucinations. I am not saying the bubble will burst, but valuations must come down.

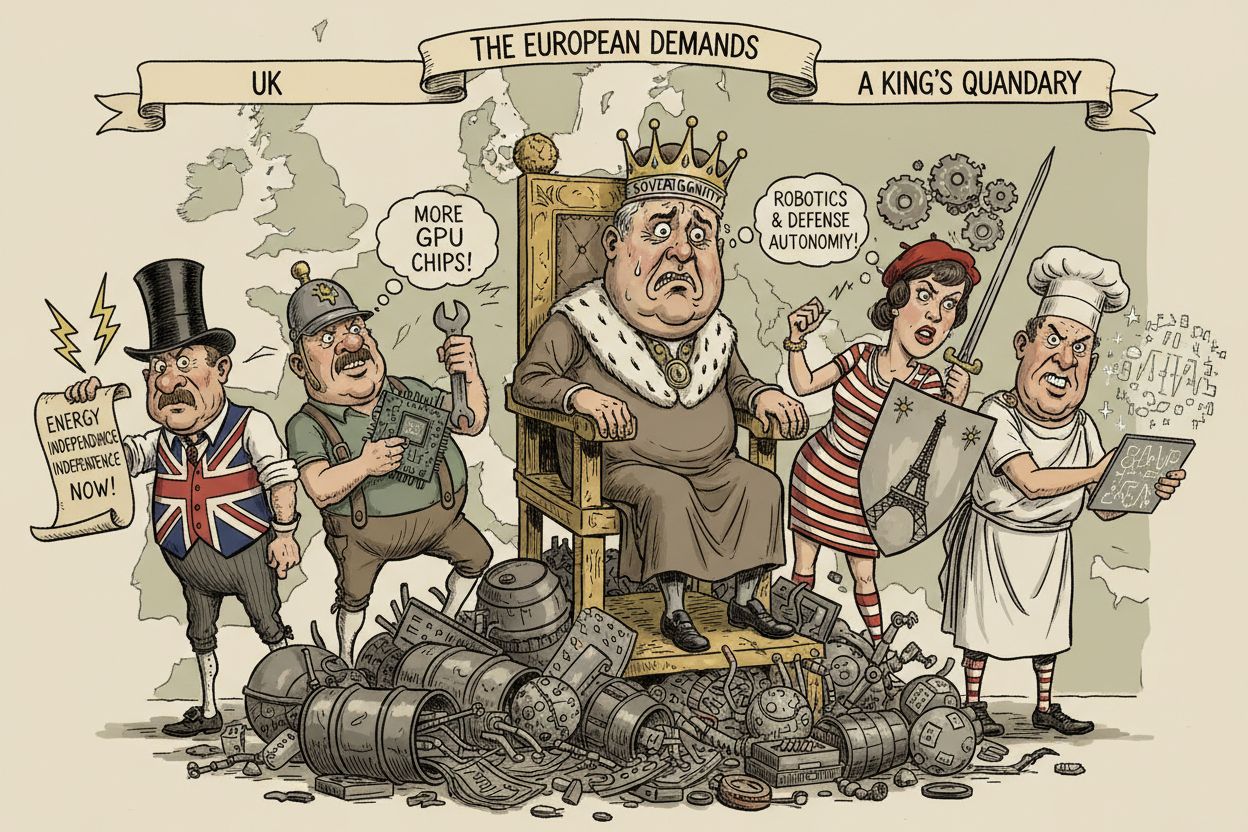

6. The Money is in Sovereignty

In 2025, the US raised about $250 billion in private tech funding. Europe raised about $45 billion. That gap is painful, and private capital will remain tight next year.

But if private investors are broke, look at the government.

We live in a fragmented world. Globalisation is dead. Countries realise they need to own their own stack: energy, defense, chips. New funds like the European Defence Fund are pouring money into this.

If you are building a SaaS marketing tool, good luck. But if you are building "sovereign tech" that helps Europe stand on its own feet, the checkbook is open.

7. The Work Revolution

2026 is when AI agents start talking to each other. We are moving from "have your person call my person" to "have your bot talk to my bot."

This kills the "per seat" pricing model.

If an AI agent does the work of 10 juniors, charging for one "seat" loses you money. We will see a massive flip to usage-based pricing. If you are a B2B founder, change your model now before you go broke.

8. The Year of Robots

Finally, the physical world strikes back.

We have talked about it for decades, but robotics is finally real. Uber and Lyft are planning robotaxi trials in London in early 2026. We will see more robots in daily life, moving from toys for the rich to affordable tools.

Summary

2026 is not about the next shiny chatbot.

It is about physics, offline data, and resilience. The easy money is gone. The valuations are coming down. But for the founders who solve real problems in the real world, this is the best time to build.

Happy New Year.

✅ Do a friend a favor. Forward this to a founder who thinks 2026 will be business as usual. They need to see this before January starts.

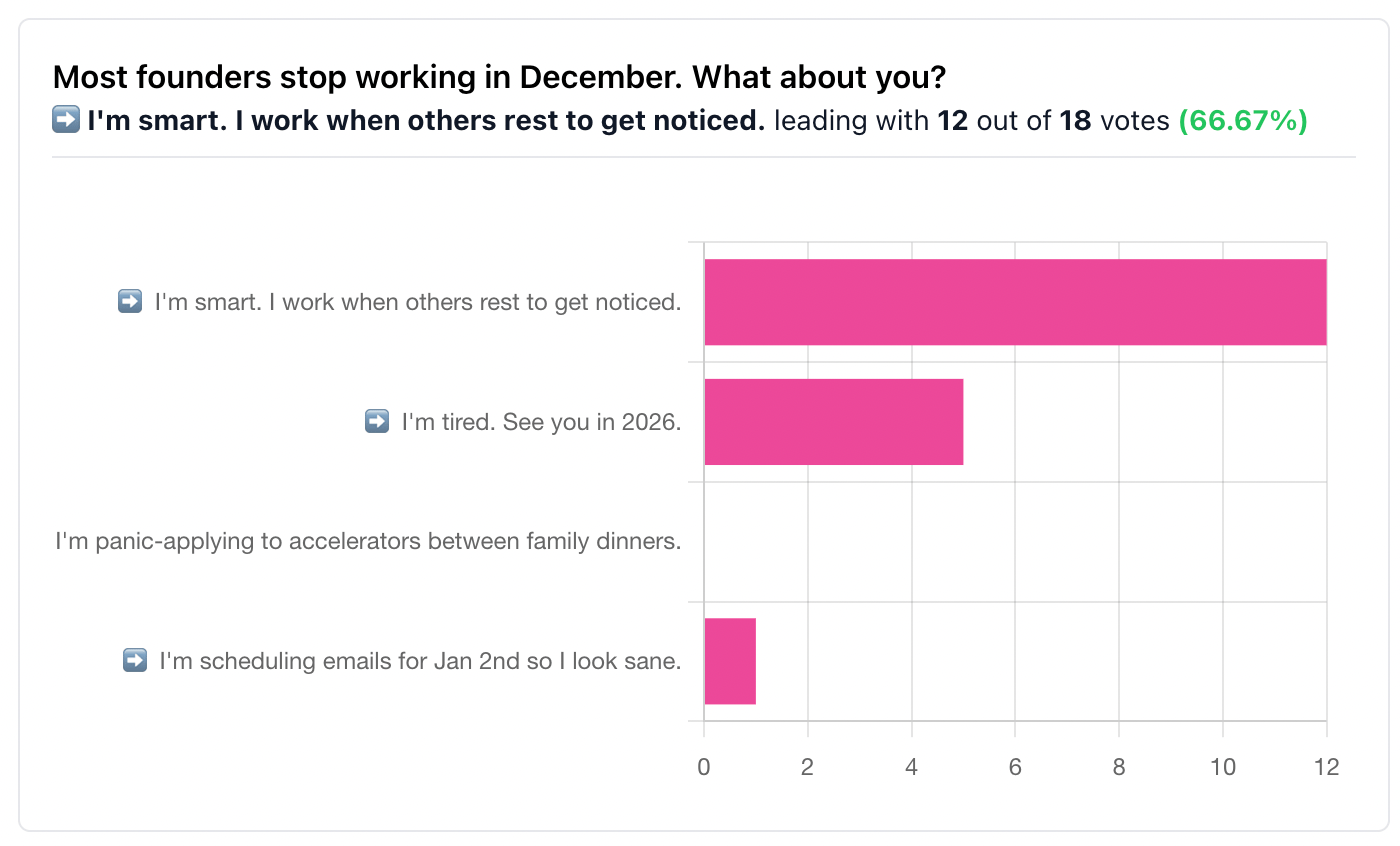

POLL TIME

(👉 Vote now — we’ll share the results in next week’s issue. All votes are anonymous.)

I’ve placed my bets for 2026. Which of these 8 predictions is guaranteed to happen?

- 🎭 The "Trustless" Era: Real, raw content wins; AI slime loses.

- 🗄️ The Data Grail: Physical/Offline data becomes the only real moat.

- 🧹 The Great Cleanup: Broken companies get swallowed by aggregators.

- 🦠 Startup "Pandemic": A flood of AI apps (most will fail).

- 📉 The AI Correction: The hype dies and valuations come down.

- 🛡️ Sovereign Money: Government funds beat private VC cash.

- 🤖 Pricing Revolution: AI Agents kill the "Per Seat" model.

- 🚕 The Year of Robots: Robotaxis and physical tech finally hit the streets.

- 🤯 All of the above: You nailed it.

- 🔮 None / You missed one: (Tell me in the comments!)

RAFE FOUNDERS EVENTS ❤️

Rare Founders

Dry Powder Open Mic: VCs & Family Offices Only

Our next event is Dry Powder Open Mic, a private mixer strictly for VCs, Family Offices, and Syndicate Leads. We are removing the noise to focus on the people who actually write the checks. Join us on January 21st for a fireside chat with Dan Bowyer (Partner at SuperSeed) on 2026 venture trends, followed by our signature investor-only open mic and high-stakes networking. No founders, no service providers—just raw deal flow and professional capital in one room.

In-person event

The Spirited Cocktail and Tapas Bar

199-206 High Holborn, London, WC1V 7BD, UK

Wed 21 Jan, 18:00 - 22:00 BST

Rare Founders

Open Mic Pitching and Networking - Fundraising 2026

Getting funded in 2026 requires a new playbook, and we are bringing the experts to you. Join us for our Open Mic Pitching and Networking night focused on the future of fundraising. We will host a VC panel to discuss the latest trends, tactics, and metrics you need to survive the next market shift. Between the insights, we are running our legendary open mic: 60 seconds to pitch your startup or meet the water guns. Whether you are raising or just need to connect with the right people, this is the room where the UK startup scene comes alive.

In-person event

45 Club

45 Curtain Road, London, EC2A 3PT, UK

Wed 28 Jan, 18:00 - 22:00 BST

Rare Founders - building the bridge between founders and investors via regular in-person and online events, meetups, conferences.